closed end credit disclosures

For a closed-end credit transaction subject to 102619e and f opens new window real property or a cooperative unit does the credit union provide disclosures required under 102637 opens new window Loan Estimate and 102638 opens new window Closing Disclosure. 2 The number of payments or period of repayment.

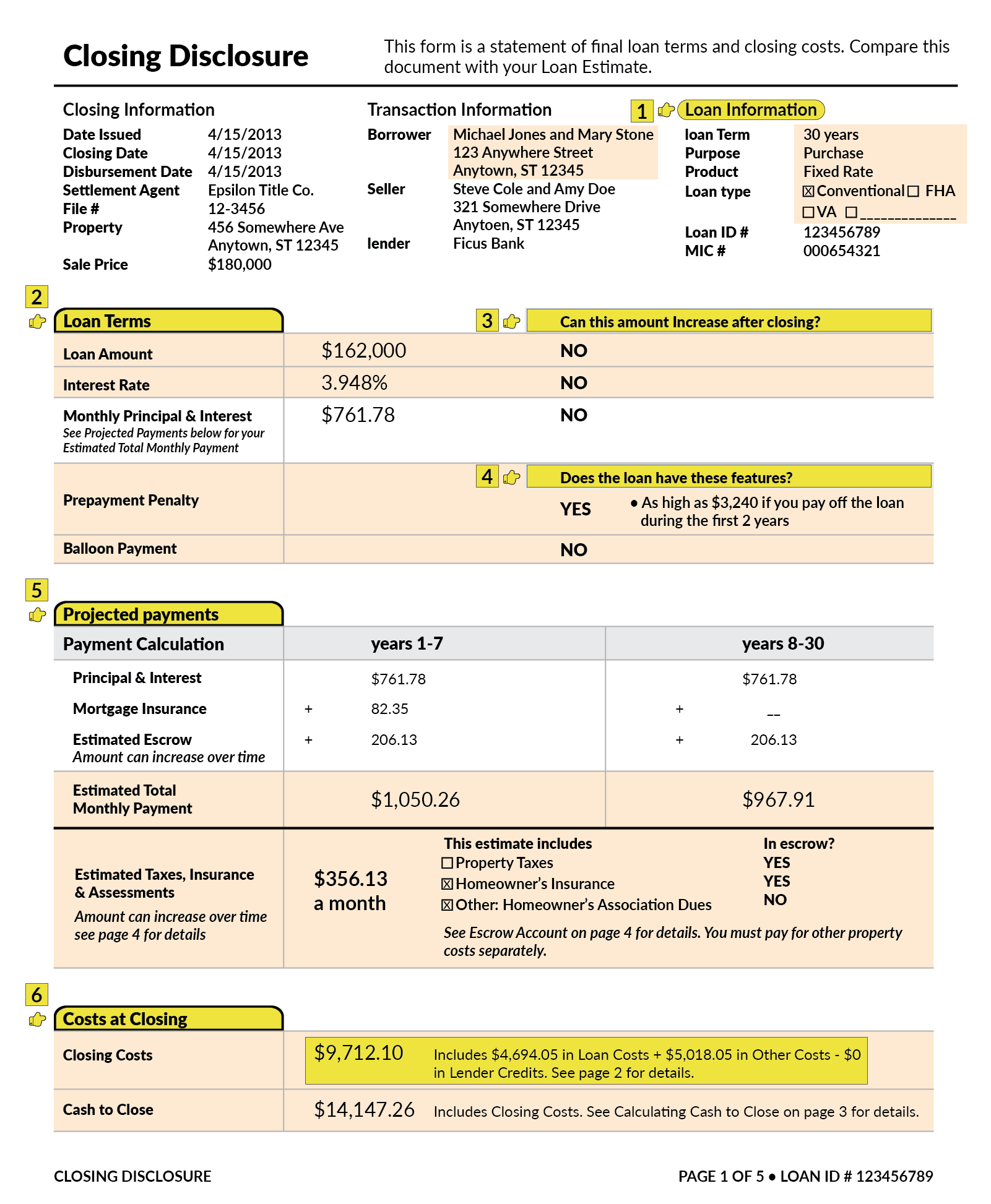

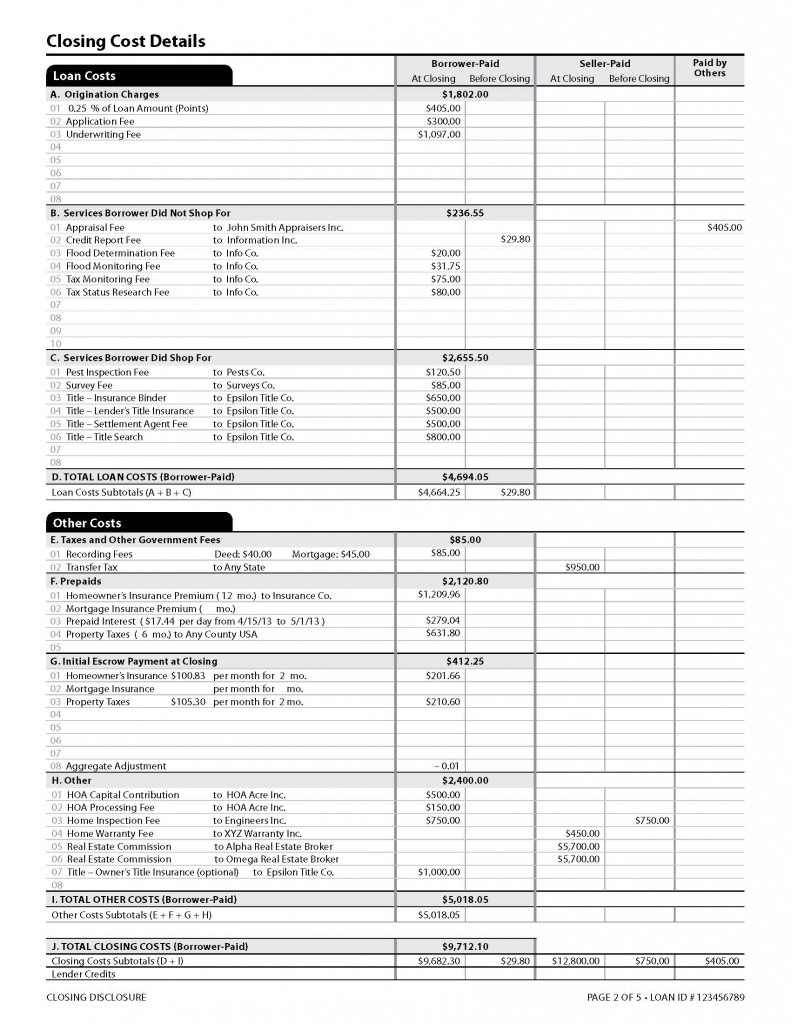

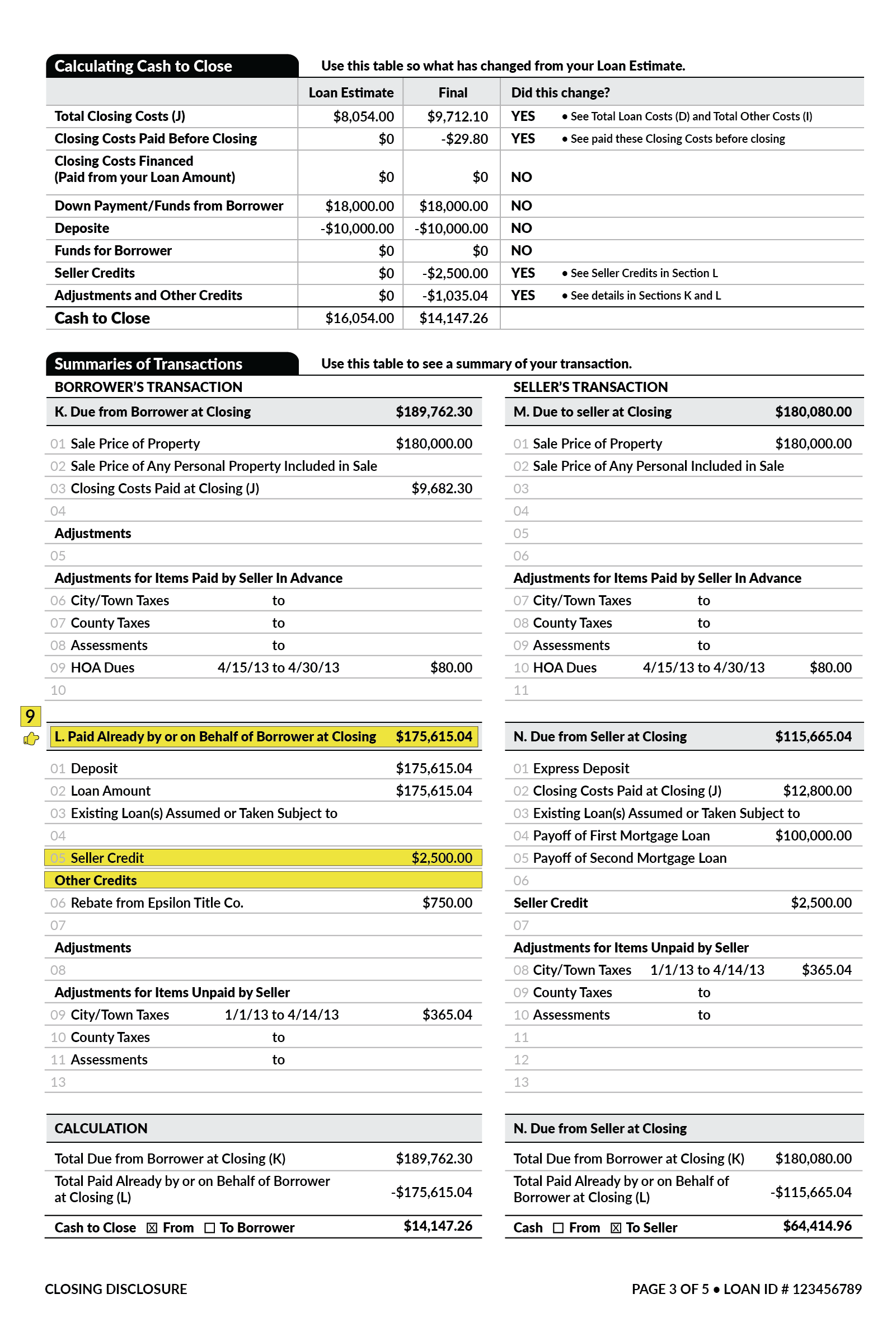

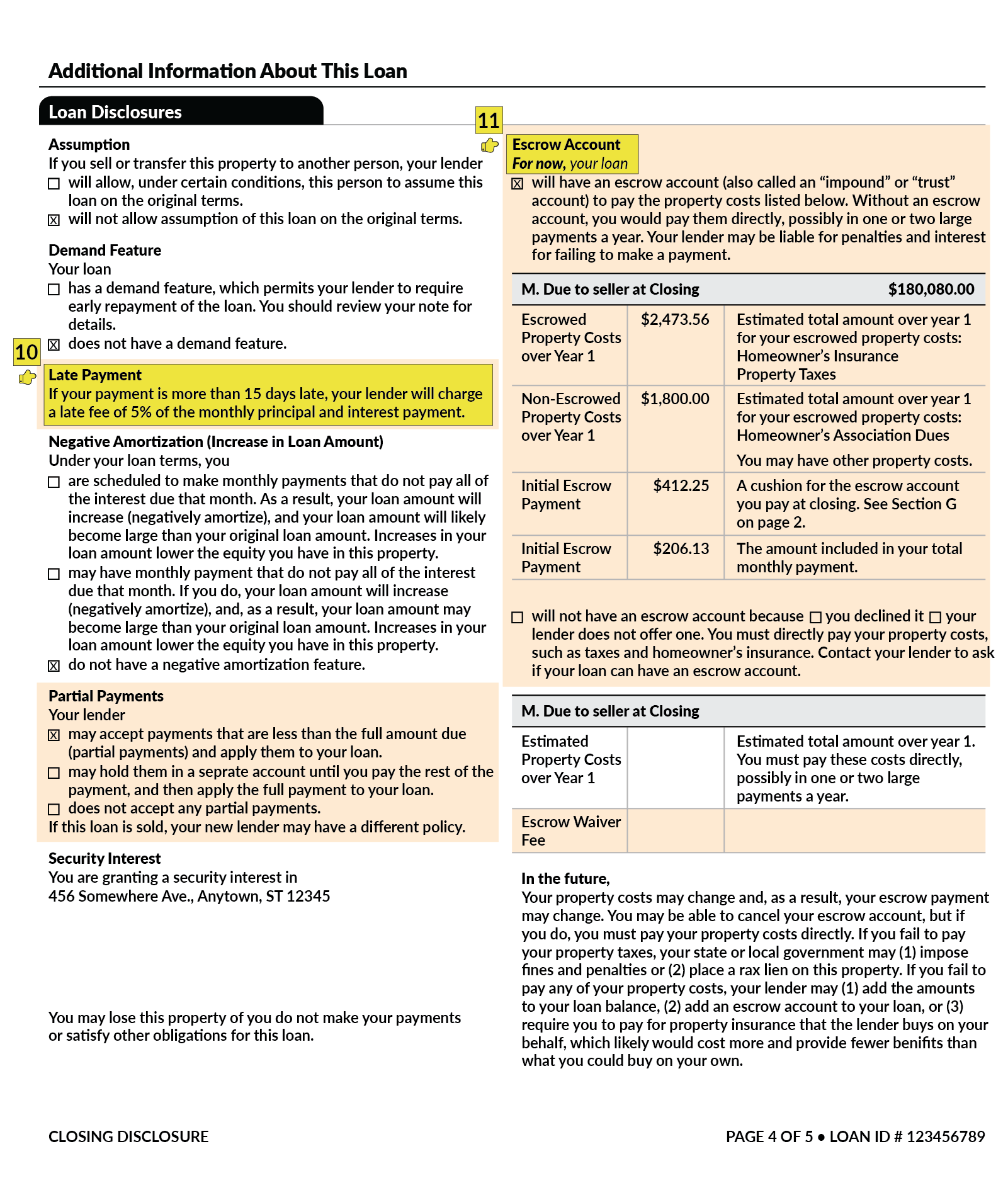

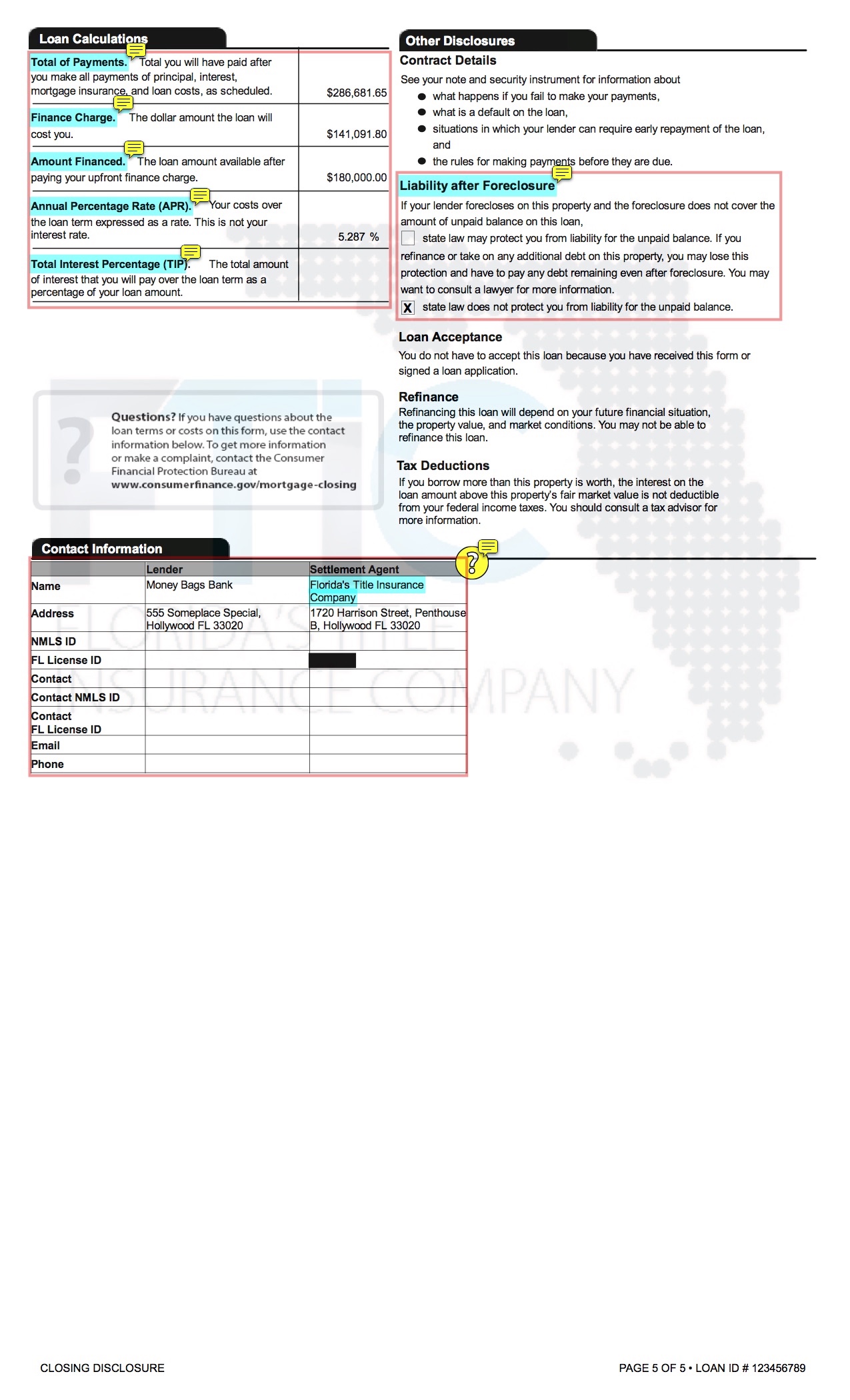

What Is A Closing Disclosure Lendingtree

For closed end dwelling-secured loans subject to RESPA does it appear early disclosures.

. 22620 Subsequent disclosure requirements. 102658 Internet posting of credit card agreements. Item Description Yes No NA.

2268 is the principal section for closed end credit disclosures. In a closed-end consumer credit transaction secured by a first lien on real property or a dwelling other than a reverse mortgage subject to 102633 for which an escrow account was established in connection with the transaction and will be cancelled the creditor or servicer shall disclose the information specified in paragraph e2 of this section in accordance with the form. Open-end credit is not restricted to a.

Annual Percentage Rate Definition 12 CFR 102622 Closed-End Credit 28 SUBPART B OPEN-END CREDIT 31 Time of Disclosures Periodic Statements 12 CFR 10265b 31 Subsequent Disclosures Open-End Credit 12 CFR 10269 32 Finance Charge Open -End Credit 12 CFR 10 266a1 10266b3 33. If a closed-end consumer credit transaction is secured by real property or a cooperative unit and is not a reverse mortgage the creditor discloses a projected payments table in accordance with 102637c and 102638c as required by 102619e and f. For residential mortgages and extensions of credit secured by the members dwelling the disclosures must be provided within three 3 business days after receiving the.

Regulation Z now contains two new forms required for most closed-end consumer mortgage loans. The use of positive numbers also triggers further disclosure. Trigger terms when advertising a closed-end loan include.

In a closed-end consumer credit transaction secured by a first lien on real property or a dwelling other than a reverse mortgage subject to 102633 for which an escrow account was established in connection with the transaction and will be cancelled the creditor or servicer shall disclose the information specified in paragraph e2 of this section in accordance with the form. Section 102633 requires special disclosures including the total annual loan cost rate for reverse mortgage transactions. Section 102632 requires certain disclosures and provides limitations for closed-end credit transactions and open-end credit plans that have rates or fees above specified amounts or certain prepayment penalties.

12 percent Annual Percentage Rate or a 15 annual membership fee buys you 2000 in credit. The disclosures required under subsection a with respect to any open end consumer credit plan which provides for any extension of credit which is secured by the consumers principal dwelling and the pamphlet required under subsection e shall be provided to any consumer at the time the creditor distributes an application to establish an. 4 The amount of any finance charge.

Closed-End Credit Disclosure Forms. Subpart AProvides general information that applies to both open-end and closed-end credit. The disclosure rules of Regulation Z differ depend ing on whether the credit is open-end credit cards and home equity lines for example or closed-end such as car loans and mortgages.

Determine that the disclosures are clear conspicuous and grouped together or segregated as required in a form the consumer may keep. Regulation Z is structured accordingly. 102661 Hybrid prepaid-credit cards.

If any triggering term is used in a closed-end credit advertisement then the following three disclosures must also be included in that advertisement. 22623 Right of rescission. 102657 Reporting and marketing rules for college student open-end credit.

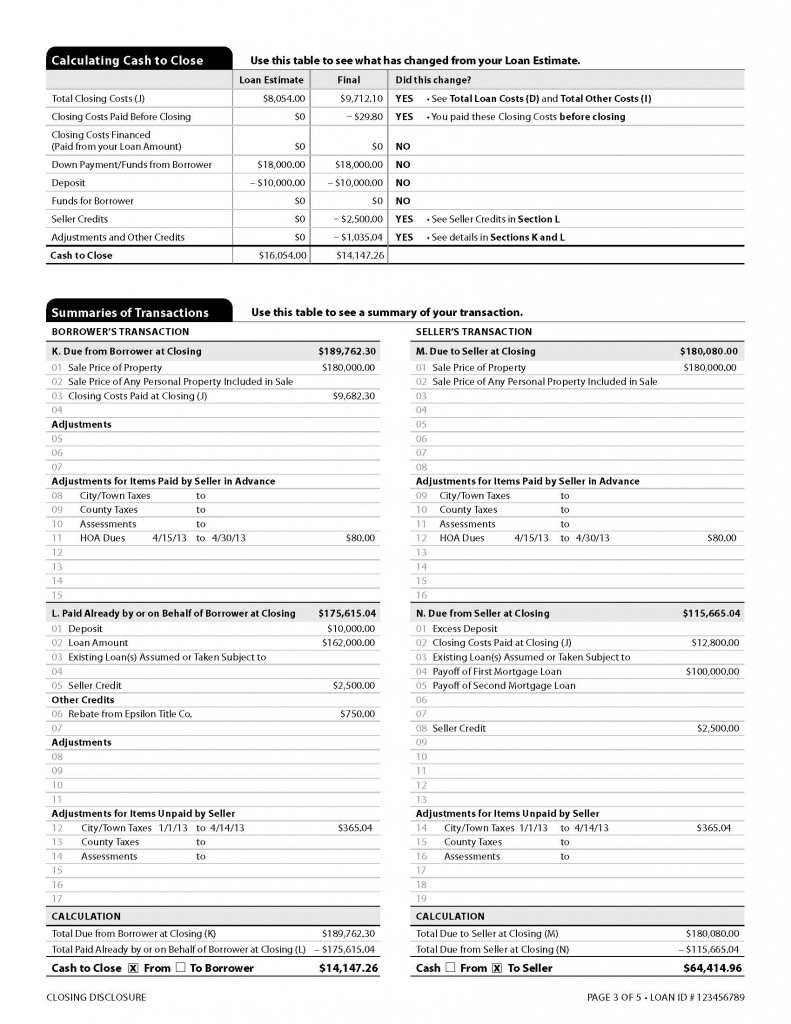

The Loan Estimate is provided within three business days from application and the Closing Disclosure is provided to consumers three business days before loan consummation. 22618 Content of disclosures. The terms Finance Charge and Annual Percentage Rate and corresponding rates or amounts should be more conspicuous than.

The premium may be disclosed on a unit-cost basis only in open-end credit transactions closed-end credit transactions by mail or telephone under 102617g and certain closed-end credit transactions involving an insurance plan that limits the total amount of. The annual percentage rateusing that term spelled out in full. 22619 Certain mortgage and variable-rate transactions.

22622 Determination of annual percentage rate. 102660 Credit and charge card applications and solicitations. Sub-sections a and b cover all types of closed end transactions and then the various following subsections have specific requirements for credit sales for consumer loans for mail or telephone transactions etc etc.

The Credit Union will provide the proper closed-end disclosures to the consumer borrower before consummation of the transaction. 22617 General disclosure requirements. 3 The amount of any payment.

Excluding chattel-dwelling-secured loans from the integrated disclosure requirements means they would not be subjected by this rulemaking to certain new disclosure requirements added to TILA section 128a by the Dodd-Frank Act. An advertisement including any of the previous triggering terms must also include each of the following disclosures as applicable. The amount or percentage of the down payment.

1 The amount or percentage of any downpayment. If the annual percentage rate may be increased after. 12 CFR Subpart C - Closed-End Credit.

The terms of repayment. Closed-end credit includes debt instruments that are acquired for a particular purpose and a set amount of time. 102659 Reevaluation of rate increases.

A trigger term is an advertised term that requires additional disclosures. 22621 Treatment of credit balances. Closed-End Credit Disclosure Forms Review Procedures a.

Rather they would remain subject to the existing closed-end TILA disclosure requirements under 102618.

Mandatory Disclosures To Consumer

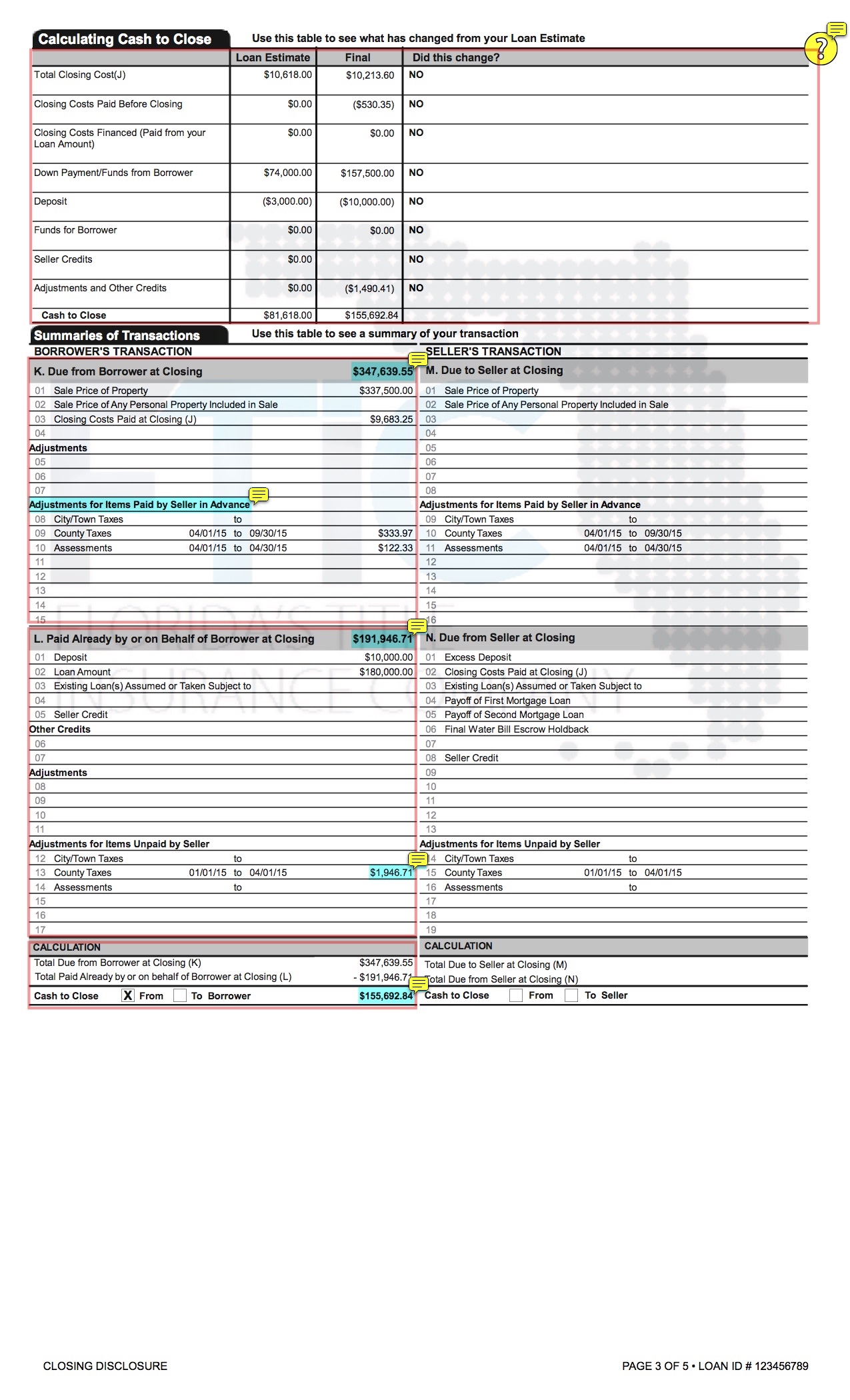

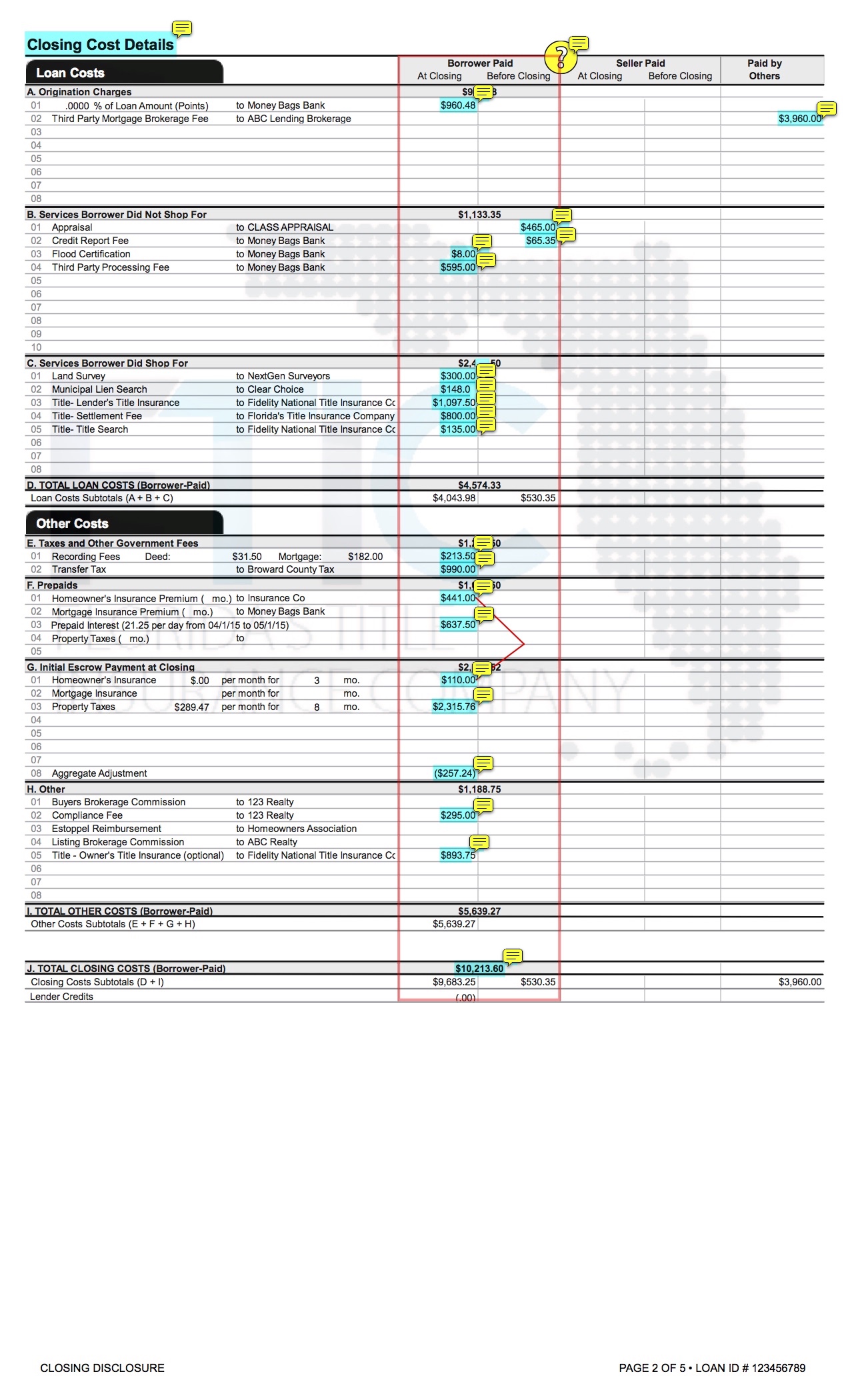

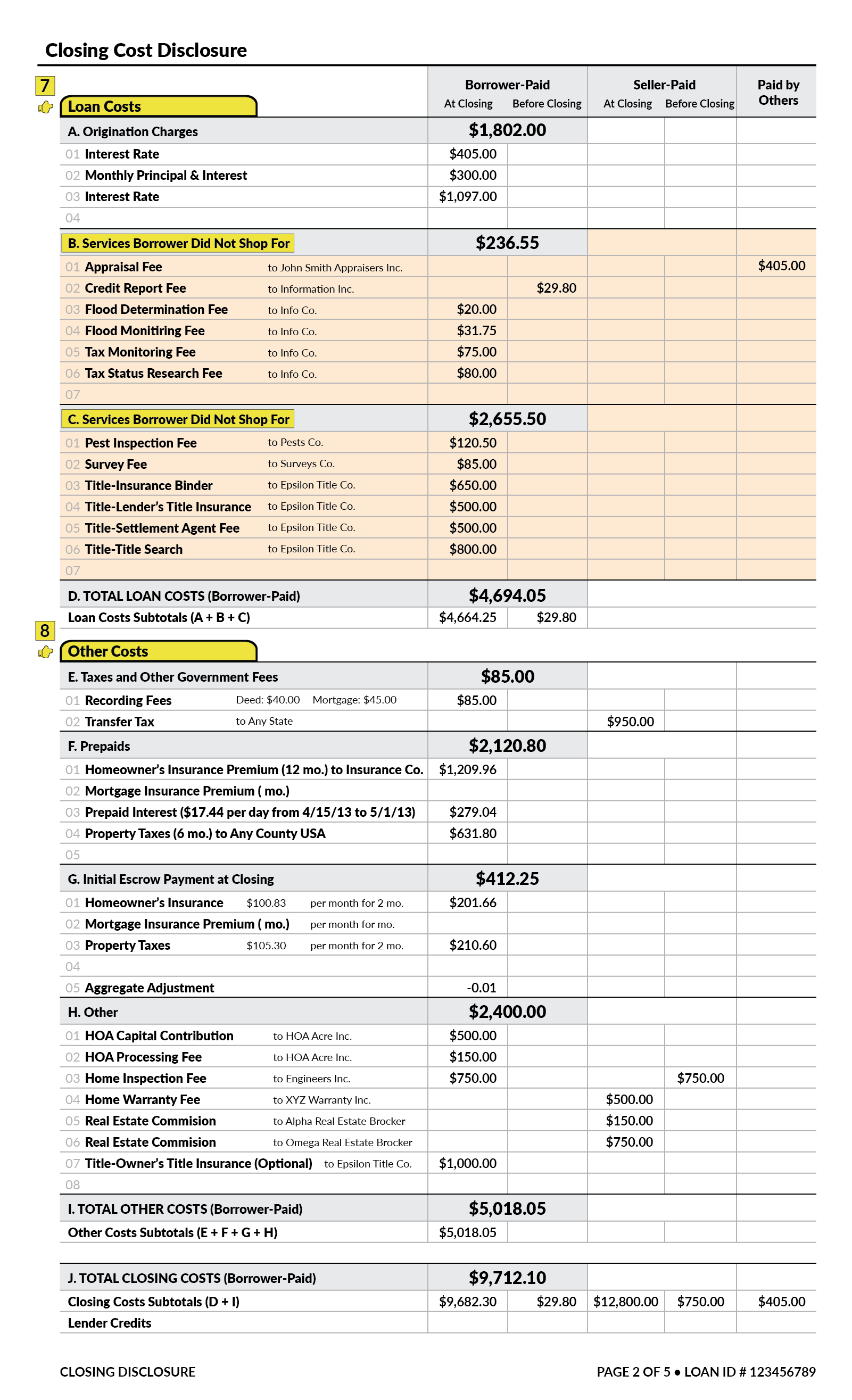

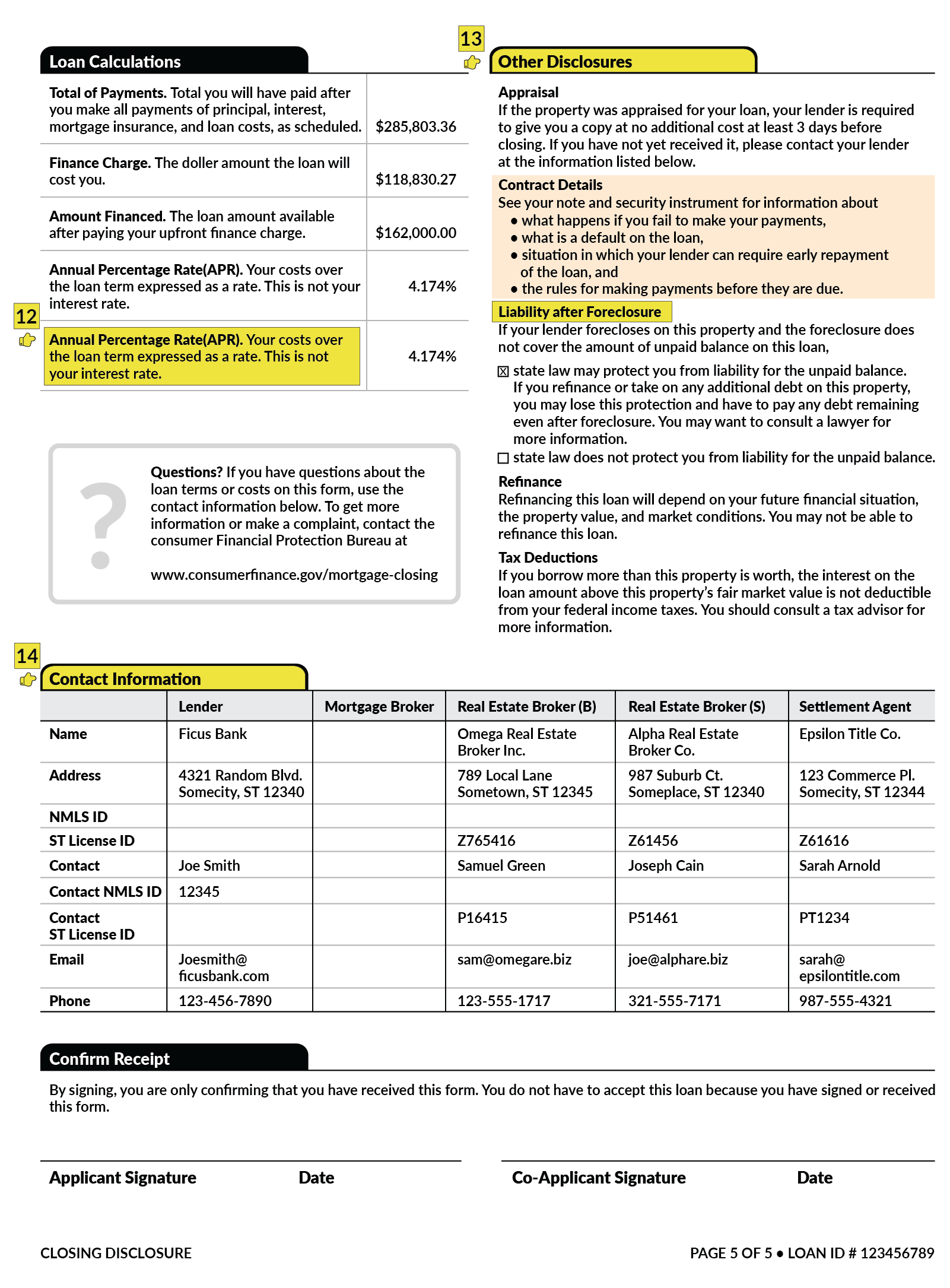

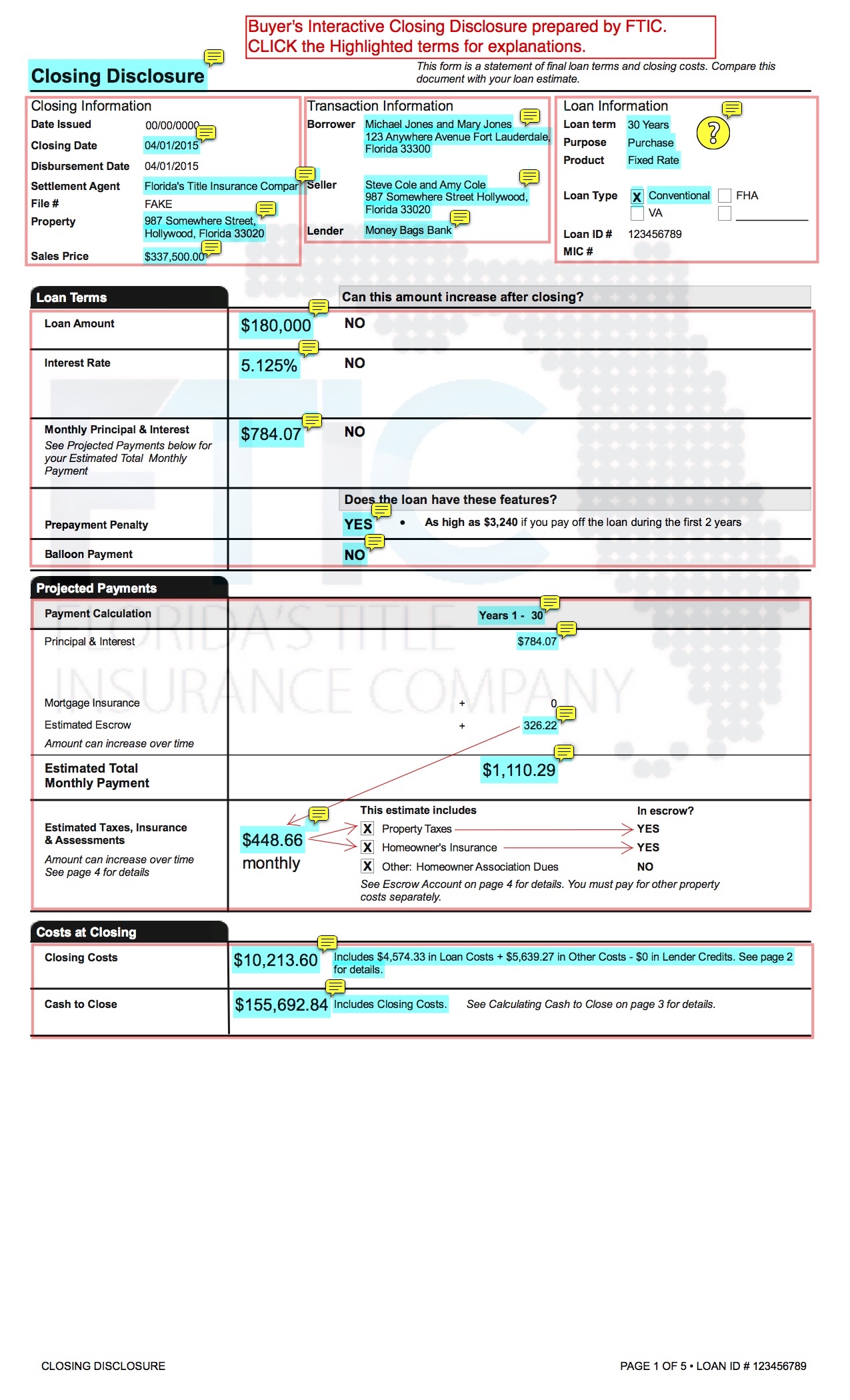

How To Read A Buyer S Closing Disclosure Florida S Title Insurance Company

How To Read A Buyer S Closing Disclosure Florida S Title Insurance Company

Can I Get A Hud Florida Agency Network

How To Comply With The Closing Disclosure S Three Day Rule Alta Blog

Fdic Law Regulations Related Acts Consumer Financial Protection Bureau

Federal Register Truth In Lending Regulation Z

Fdic Law Regulations Related Acts Consumer Financial Protection Bureau

Can I Get A Hud Florida Agency Network

Definition Closed End Credit Is Defined As Credit That Must Be Repaid In Advisoryhq

What Is A Closing Disclosure Lendingtree

New Mortgage Documents What Are They

What Is A Closing Disclosure Lendingtree

Understanding Finance Charges For Closed End Credit

Fdic Law Regulations Related Acts Consumer Financial Protection Bureau

How To Read A Buyer S Closing Disclosure Florida S Title Insurance Company

What Is A Closing Disclosure Lendingtree

What Is A Closing Disclosure Lendingtree

How To Read A Buyer S Closing Disclosure Florida S Title Insurance Company