washington state sales tax everett wa

Use our local tax rate lookup tool to search for rates at a specific address or area in Washington. 98201 98203 98206 98207 and 98213.

Snohomish County Proposes 0 1 Sales Tax For Affordable Housing Heraldnet Com

Everett is located within Snohomish County.

. Use this search tool to look up sales tax rates for any location in Washington. The seller is liable. Use tax applies to all tangible personal property used in Washington when the states sales tax has not been paid.

2020 rates included for use while preparing your income tax. Ad Free Avalara tools include monthly rate table downloads and a sales tax rate calculator. The Everett Washington sales tax is 970 consisting of 650 Washington state sales tax and 320 Everett local sales taxesThe local sales tax consists of a 320 city sales tax.

The minimum combined 2022 sales tax rate for Everett Washington is. The sales tax rate for Everett was updated for the 2020 tax year this is the. The Everett Washington sales tax rate of 99 applies to the following five zip codes.

Use our local tax rate lookup tool to search for rates at a specific address or area in Washington. The Washington WA state sales tax rate is currently 65. Sales Use Tax Filing Reporting Remittance.

Retail Sales and Use Tax. The 98201 Everett Washington. Retail sales tax includes both state and local components.

The latest sales tax rate for Everett WA. Rates include state county and city taxes. ZIP--ZIP code is required but the 4 is optional.

Download the latest list of location codes and tax rates for cities grouped by county. Ad The only solution with end-to-end sales tax technology that manages your entire process. What is the sales tax rate in Everett Washington.

Lists of local sales use tax rates and changes as well as information for lodging sales motor vehicles sales or leases and annexations. The average cumulative sales tax rate in Everett Washington is 1006. Use this search tool to look up sales tax rates for any location in Washington.

Download the latest list of location codes and tax rates alphabetical by city. This rate includes any state county city and local sales taxes. How much is sales tax in Everett in Washington.

Depending on local municipalities the total tax rate can be as high as 104. Choose Avalara sales tax rate tables by state or look up individual rates by address. This includes the rates on the state county city and special levels.

31 rows The latest sales tax rates for cities in Washington WA state. An alternative sales tax rate of 106 applies in the tax. Sales tax in Everett Washington is currently 97.

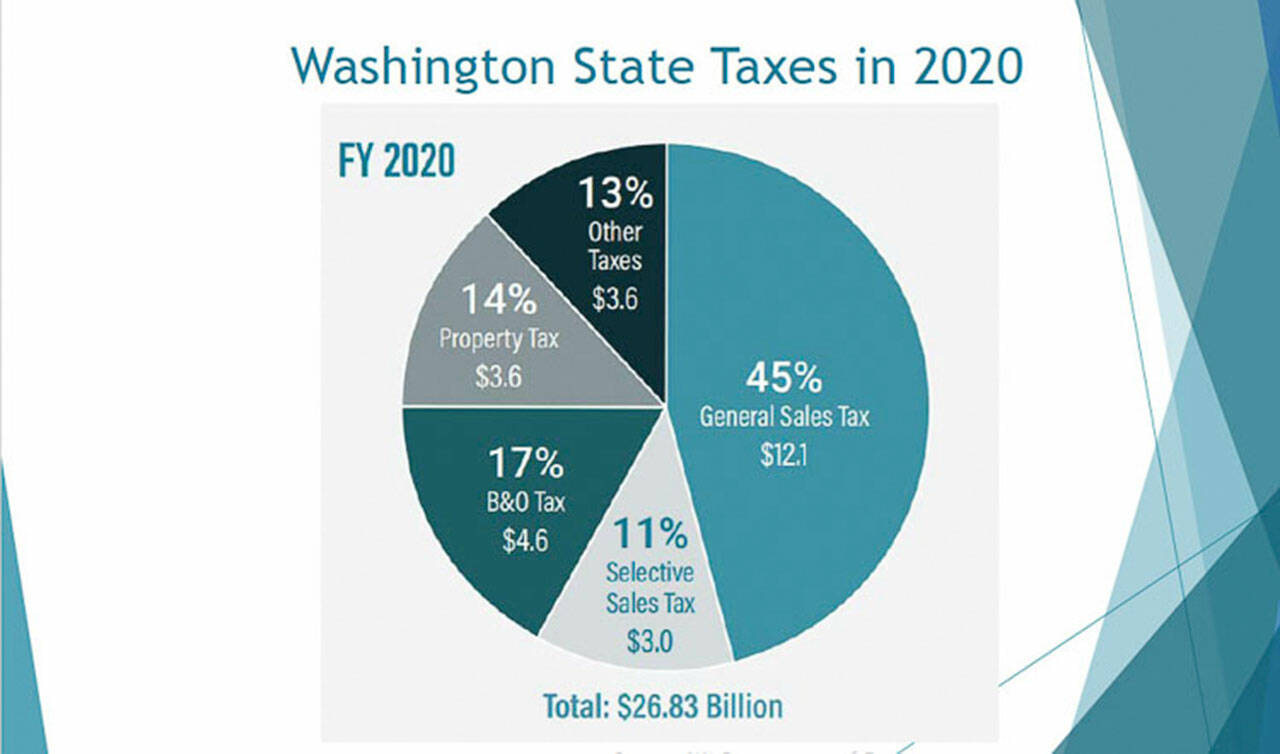

Quarterly tax rates and changes. It is comprised of a state component at 65 and a local component at 12 38. Sales tax amounts collected are considered trust funds and must be remitted to the Department of Revenue.

2020 rates included for use while preparing your income. Use tax is paid at the time a vehicle is registered. The tax is based.

The Sales and Use Tax is Washingtons principal revenue source. The motor vehicle saleslease tax of three-tenths of one percent 03 on motor vehicles also applies when use tax is due on a vehicle. State Use TaxDeferred Sales Tax.

ZIP--ZIP code is required but the 4 is optional. The City of Everett Business and Occupation Tax BO is based on the gross receipts of your business. If you dont yet have an Everett business license.

This is the total of state county and city sales tax rates.

Everett Wa Land For Sale Acerage Cheap Land Lots For Sale Redfin

Hotel Indigo Everett Waterfront Venue In Everett Wa Zola

Washington Accounting Businesses And Tax Practices For Sale Bizbuysell

Everett Washington Antique Map Pictorial Or Birdseye Map 1893 Ebay

Washington Sales Tax Calculator And Economy 2022 Investomatica

![]()

Wa Cities Will Get Free Money From The State For Affordable Housing Crosscut

Everett Washington Wa Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

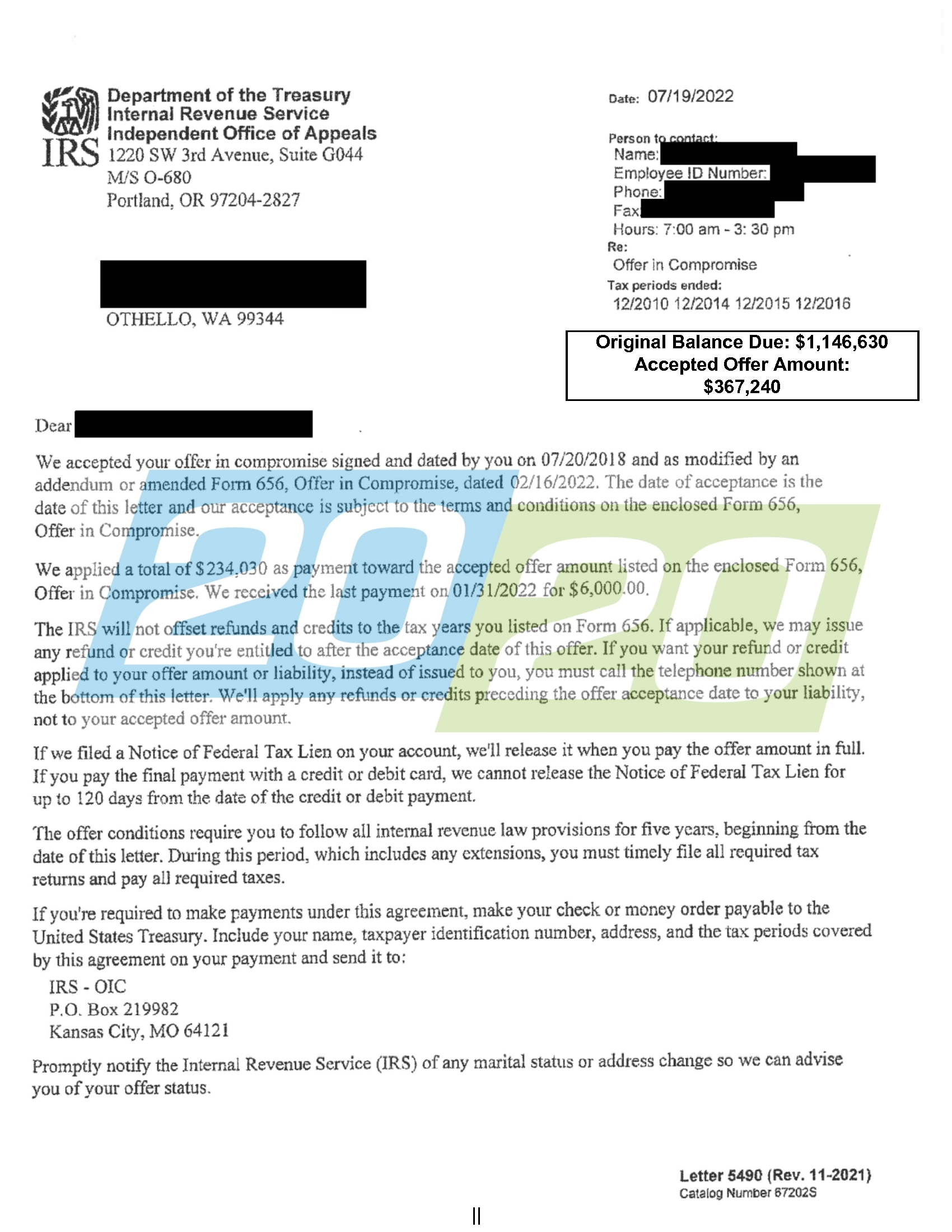

Tax Negotiations In Washington 20 20 Tax Resolution

The Property Tax Annual Cycle In Washington State Myticor

Editorial Taxpayers Deserve Down Payment On Tax Reforms Heraldnet Com

Carnegie Resource Center Opens As An Innovative Gateway To Services Pioneer Human Services

Washington State Sales Tax Rate Usgeocoder Blog

Job Opportunities City Of Everett

![]()

Update Plans To Tax The Rich Advancing In Wa Legislature In 2021 Crosscut

Private Estate Wedding Venues In Washington 21 Venues

Washington State S New Capital Gains Tax A Primer Crosscut

Who Really Pays Economic Opportunity Institute Economic Opportunity Institute